How Much Should Owner's Title Insurance Cost

However it can cost as little as a few hundred dollars for a lower-priced home and it could cost tens of thousands of dollars for a very. How much is title insurance.

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Most quotes from Title Forward include a breakout of the cost for both lenders title insurance and owners title insurance.

How much should owner's title insurance cost. The answer depends on your interests and how you purchase the home. Florida Title Insurance Endorsements. The premium for either a lenders or an owners policy is based on the homes value and can vary depending on state or county according to the Federal Reserve 1.

1 million to 5 million. As you learn about title insurance and how much it will cost youre going to ask whether you must have it. Call National Title to find out the cost of owners title insurance above 999000.

Owners Title Insurance. An owners policy if purchased separately would typically cost more than a lenders. Its important to review the prospective cost before hiring a title company.

It typically costs about 175-9 per 1000 of the homes value or about 350-1800 on a 200000 home or 700-2000 or more for a 400000 home. Its optional but generally recommended for homeowners. Generally speaking the.

Title search title examination notary fee and other closing fees are all additional costs. Thats because the Amount of the Policy can be determined by several different factors which need to be considered when you are purchasing the policy. Is owners title insurance worth the cost.

Owners Title Insurance protects the homeowner in case of any title claims made on the property. An Owners policy lasts as long as the property is in your possession so it wont need to be repurchased if you refinance your home. But most of the times the owners title insurance rate is usually 05 percent of the houses or propertys purchase price.

5 million to 10 million. The owners title insurance policy protects the home buyer homeowner from legal disputes over the ownership of the property. Over 250000 and up to 500000 add 350M Note.

Owners title insurance is never a requirement and you do not have to pay for it if you dont feel you truly needed. Both an Owners Policy OP and Loan Policy LP are to be issued. A title search for a typical single-family home will cost between 100 and 250 while a more complex multi-parcel raw land search could cost upwards of 1000 she said.

Check with your title company for the cost prior to having them complete the search. Recording Fees - Recording fees for a document are 300 per page. The quotes above reflect only the owners title insurance not the lenders title insurance before all fees.

Our simple-to-use design allows you to get the title rate information you need when you need it. Title insurance rates are REGULATED by the State of Ohio therefore title insurance rates should not vary between title insurance companies. While the exact amount youll pay for homeowners title insurance will vary depending on the purchase price of the home Raphaely said most people can expect to pay about 1000 for typical owners title insurance coverage.

Search and Examination Fees - The search and examination fees are included in the title insurance premium in Idaho. Lets say you bought your house at 300000 taking 05 percent of the price will give you a price of 1500 per year. Sellers can estimate their closing costs with the Seller Cost Calculator.

Please send me an E-mail if you see an error or want to make a comment. Discover why we suggest you forgo owners title insurance only if you can stomach random risks and more. ALTA 41 Condo 25 OPLP.

The minimum premium amount for owners insurance is. 575 per 1000 min 100 100000 to 1 million. You would think it is pretty easy to figure out how much title insurance to buy.

The calculator will calculate insurance up to an amount of 99999900. Calculate the Ohio title insurance rate estimate the OH transfer tax known as the Ohio conveyance fee. In this article we will discuss the average cost of such a policy and other things you need to know.

Whether youre creating a Net Sheet calculating a Good Faith Estimate or simply need to calculate title rates and fees let First Americans intuitive rate calculator be your guide. First of all lets talk about Owners Policies. However the costs can still increase depending on the additional fees you need to cover.

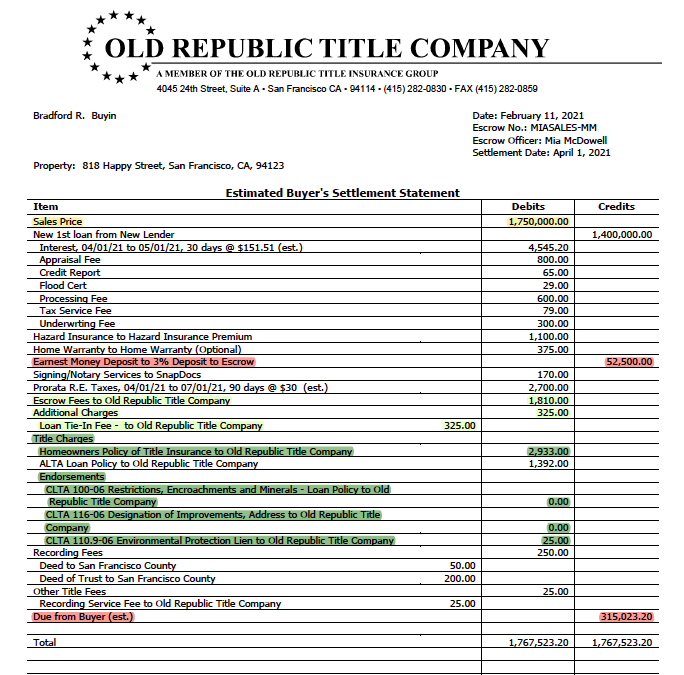

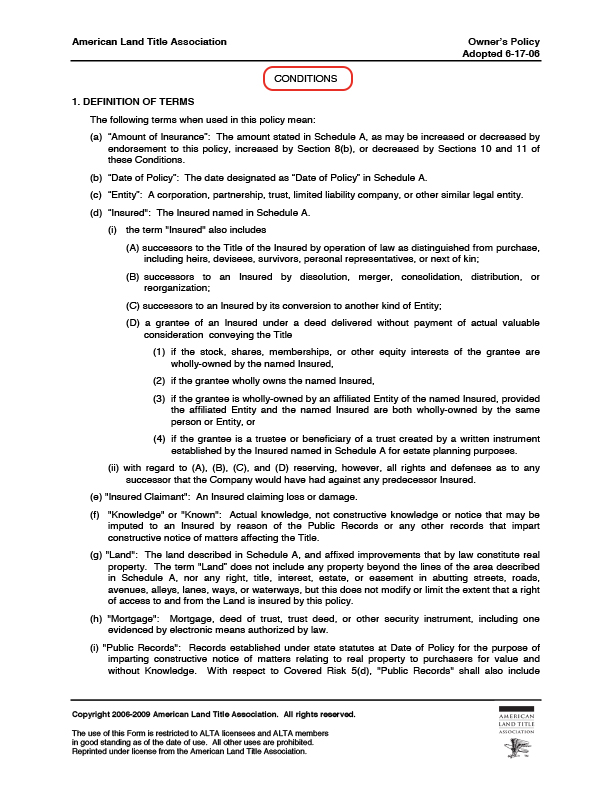

The Estimated Settlement Statement Jackson Fuller Real Estate

3 Things To Know Before Buying Owner S Title Insurance Clark Howard

Buyer Closing Costs Explained The Arlington Expert

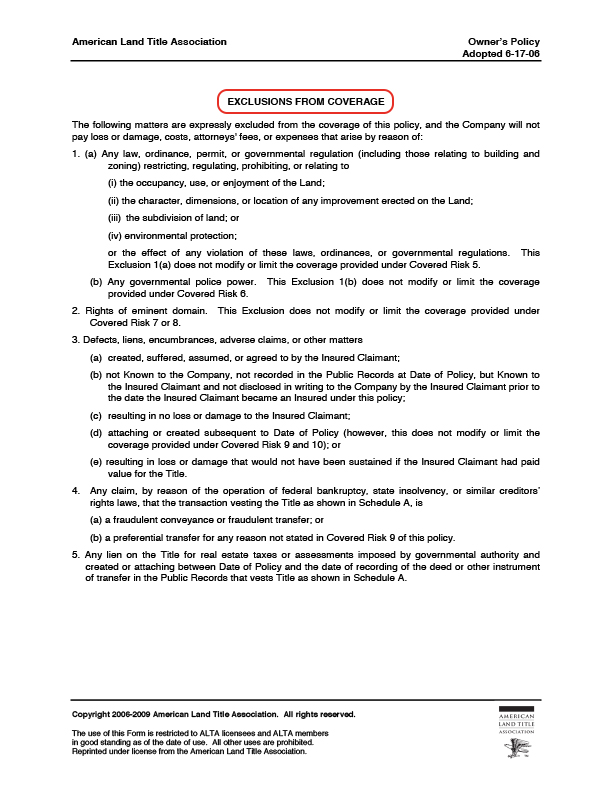

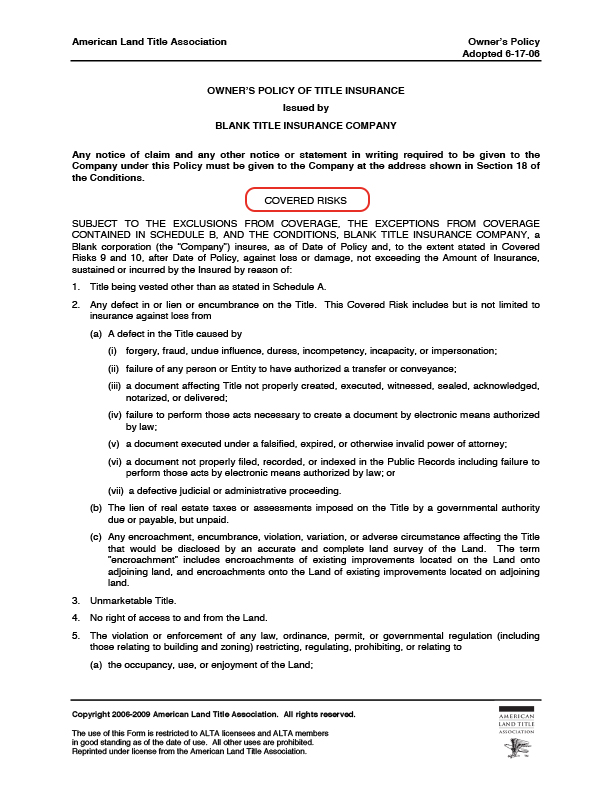

Parts Of A Title Policy Home Closing 101

Parts Of A Title Policy Home Closing 101

Parts Of A Title Policy Home Closing 101

Title Insurance Is A Type Of Insurance That Provides Protection Against Hidden Issues With The Title To A Proper Title Insurance Estate Lawyer Insurance Policy

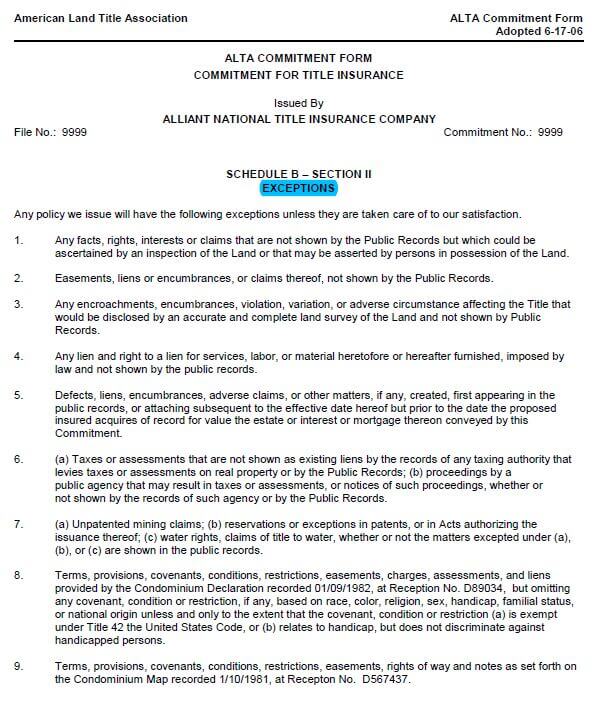

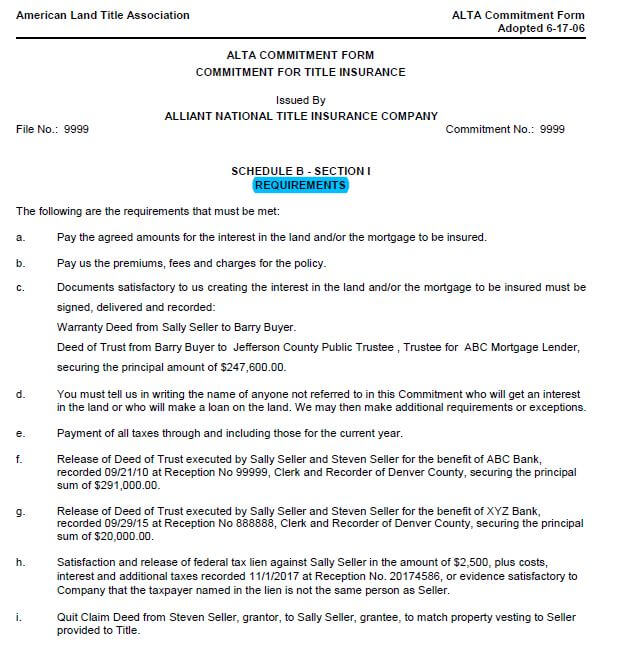

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Parts Of A Title Policy Home Closing 101

How Much Is Title Insurance Smartasset Com

Illinois Title Insurance Calculator With 2021 Rates Elko

Title Insurance Comparison Of Coverages Residential Owner S Policies Title Insurance Insurance Policy Insurance Comparison

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

The Importance Of An Owner S Title Insurance Policy Title Insurance Insurance Marketing Insurance Policy

Title Insurance What You Need To Know Rocket Mortgage

Owners Title Insurance Title Insurance Insurance Marketing Real Estate Buyers

Post a Comment for "How Much Should Owner's Title Insurance Cost"